10 Benefits of Doing Business in Hong Kong

Hong Kong is a popular jurisdiction for foreign investors and entrepreneurs. Not only does it provide access to mainland China, but doing business in Hong Kong also means you will benefit from a tax-friendly environment, international market and pro-business policies.

Want to know why you would want to set up a business in Hong Kong? Here are 10 benefits of doing business in Hong Kong.

1. Strategic hub in Asia

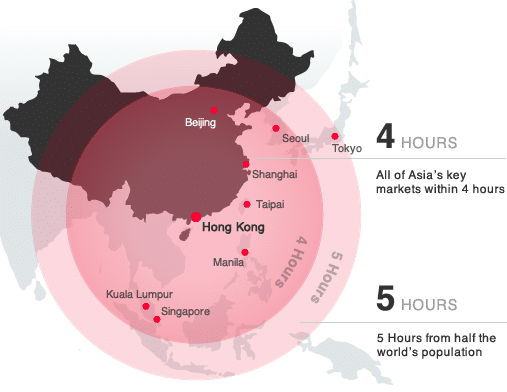

Hong Kong is the perfect location to reach many Asian countries as well as mainland China. Within 4 flight hours, all of Asia’s key markets can be reached. And a 5-hour flight radius covers half the world’s population.

Major business cities such as Shanghai, Beijing, Taipei, Singapore, Perth, Kuala Lumpur and Manila are in the same time zone as Hong Kong, while Bangkok, Ho Chi Minh City, Seoul and Tokyo just have a one-hour difference.

On a smaller scale, Hong Kong and Shenzhen are connected by road, MTR and the High Speed Rail. The latter is part of the Guangzhou-Shenzhen-Hong Kong Express Rail Link, connecting Hong Kong and Guangzhou via Shenzhen since 2018. The journey time between the two major cities is less than an hour, while Hong Kong-Shenzhen is a mere 15-minute-train ride.

Also operating since 2018 is the Hong Kong-Zhuhai-Macao Bridge, creating a road connection between Hong Kong and Macau, with further access to the Pearl River Delta.

2. Preferential access to mainland China

Hong Kong is known as the gateway to mainland China. Not only due to its physical proximity but also because of the preferential market access from the Closer Economic Partnership Agreement (CEPA).

The CEPA is a free trade agreement between the Central Government of the People’s Republic of China and the Hong Kong SAR Government, providing exclusive mainland market access benefits, such as exporting without any tariffs.

3. Ease of company registration

It is relatively easy to register a company in Hong Kong. Compared to neighbouring countries, opening a company in Hong Kong does not require approval from government officials.

The most common business entity is the Private Limited Company by Shares (“Limited Company”).

You can register your company in about two weeks and the total cost is relatively low compared to other jurisdictions. The capital entrance requirement is practically non-existent with HK$1 (ca. US$0.13).

Although the company registration process is easy, the forms and supporting documents may be considered complex for some. A service provider, like HKWJ Group, may help.

4. Low tax regime

One of the main reasons Hong Kong is renowned for doing business is its low tax rates and predictable tax system.

Hong Kong only imposes three kinds of direct taxes:

- Profits tax (for incorporated bodies)

- Salaries tax (for personal income)

- Property tax (for income sourced from Hong Kong property)

Since April 2018, a two-tier profits tax regime is applicable for Hong Kong-based companies:

- Incorporated bodies: the first HK$2 million of profits is taxed at 8.25%, the remainder at 16.5%

- Unincorporated bodies: the first HK$2 million of profits is taxed at 7.5%, the remainder at 15%

Salaries tax is calculated at either a progressive rate (2-17%) or a fixed rate of 15% (whichever results in a lower tax bill).

Another significant tax benefit is the territorial tax system that applies in Hong Kong. Only income that arises in and is derived from Hong Kong is subject to tax. Profits made outside of Hong Kong are tax-free.

In Hong Kong there is no sales tax or VAT, neither withholding tax, capital gains tax, dividends tax or estate tax.

5. Free economy

Hong Kong is a liberal economy driven by the principles of free enterprise, free trade and free market, which creates a fair competing ground for businesses.

The jurisdiction consistently ranks as the world’s freest economy. There are no restrictions on inward and outward investments, no foreign exchange controls and no foreign ownership restrictions.

Hong Kong has the status of a “free port” and straightforward customs clearing. Duty is only paid on limited product categories, such as tobacco, liquors (with a certain alcohol rate, wine and beer are not included here), hydrocarbon oil and methyl alcohol.

Some other countries may have a limitation on capital flow, but Hong Kong offers free flow of capital.

Other factors strengthening Hong Kong’s position as a business destination are its sizeable foreign exchange reserves, no public debt and strict anti-corruption regimen.

6. The Hong Kong Dollar is pegged to the US Dollar

Hong Kong’s monetary policy is to maintain a stable external exchange value of the Hong Kong Dollar. The currency is pegged to the US Dollar, meaning the Hong Kong Monetary Authority has a mandate to keep the currency trading between HKD 7.75-7.85 per USD. This band was set in 1983 and has not been broken since.

The link between the two currencies is considered an anchor for financial stability. A stable currency is important for an open economy like Hong Kong, where trade and logistics are key drivers.

As the currency is relatively safe and easily convertible, investors often park their money in Hong Kong, which is one of the reasons the city became a global financial centre.

7. A well-developed banking and finance system

Hong Kong has been crowned the title of having the highest concentration of banking institutions. 70 of the world’s 100 largest banks are located in the city.

In total there are about 200 authorised institutions: 164 licensed banks, 13 deposit-taking companies and 17 restricted license banks (data of 2020).

Hong Kong’s stock market is one of the largest in the world, ranking #7 worldwide and #4 in Asia. In the last seven years, Hong Kong has ranked four times as the world’s leading IPO hub.

As the main connection between mainland China and the rest of the world, Hong Kong is the world’s largest Renminbi (RMB, currency of mainland China) offshore business hub. The provision of a RMB clearing platform in Hong Kong supports banks worldwide in conducting their RMB transactions.

With one of the world’s best banking systems, opening a (business) bank account would seem relatively straightforward. However, in practice, there are often hurdles and extra challenges to overcome.

In recent years, compliance and anti-money laundering regulations have increased, leading to extensive due diligence procedures when opening a business bank account.

As Hong Kong banks are very protective of their financial services, this results into providing extra documents and explanations, long processing times and no guarantee whether your bank account will be set up.

To avoid surprises and delays during the application process, working together with a corporate services provider or agency is advised. They have a lot of experience setting up business bank accounts for several types of companies and a high success rate.

8. Productive labour force

The workforce in Hong Kong is highly trained, well-educated, multicultural and skilled. Local Hong Kong employees are adaptable to international business conducted in English.

The local language is Cantonese, while a large number of employees are also able to speak Mandarin which is spoken in mainland China.

In addition, there are many international residents bringing a variety of languages such as Japanese, Filipino, French, etc.

9. Hong Kong is part of the Greater Bay Area (GBA)

In 2017 a signing ceremony was held to develop the “Greater Bay Area” (GBA): an international innovation and technology hub. A significant number of resources has been allocated to this project in the hope of cultivating the “Silicon Valley of China”.

The GBA comprises Hong Kong, Macau and 9 municipalities in Guangdong Province (South China). The total area is around 56,000 km2, with a population of 86 million and a GDP of USD 1,668.8 billion in 2020.

Hong Kong’s role in the GBA is mostly as international finance and trade centre, transportation hub as well as its renowned professional services.

The Hong Kong-Zhuhai-Macao Bridge and Guangzhou-Shenzhen-Hong Kong Express Rail Link are part of the infrastructure to foster the connection in the GBA.

10. Full ownership for foreign investors

Foreigners are permitted to have 100% ownership of a company incorporated and based in Hong Kong. The law does not impose local residency requirements, allowing a foreigner to be the sole director and shareholder.

If the company directors are not Hong Kong residents, the company is eligible for an offshore company status, meaning it only needs to pay taxes on the profits generated within Hong Kong.

You do need to have a registered office address in Hong Kong, but this may also be at a corporate services provider, so you don’t need to rent an actual office.

There is a requirement to have a local company secretary, who must be a Hong Kong resident with a registered office address in the jurisdiction. This may be an individual or a company.

It is common to work with a corporate services provider to fulfil the company secretary and registered office address requirements.

How HKWJ can help

The HKWJ Group is a one-stop holistic service provider and advisor to help your business grow.

Within the Group, Triple Eight Ltd provides a wide range of professional and corporate services, such as company secretarial services, bank account opening and company incorporation.

At HKWJ Tax Law, we assist with financial administration, such as payroll, bookkeeping and accounting, as well as tax and legal matters.

Contact us via the form below if you have any questions about doing business in Hong Kong or want to set up your Hong Kong company.