Automatic Exchange of Information for Tax Purpose in Mainland China

For the purpose of combating cross border tax evasion, Mainland China is one of the more than 100 tax jurisdictions which has committed to implement automatic exchange of information (‘AEOI’), by signing the Multilateral Convention on Mutual Administrative Assistance in Tax Matters in August 2013 and entering into the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information in December 2015.

On 28 October 2016, the State Taxation Administration of Mainland China (“STA”) has completed the collection of public opinion on the Draft Management Rule Regarding Due Diligence Investigation of Non-resident Financial Accounts Involving Tax Information (‘the Draft Management Rule’).

Subsequently on 19 May 2017, the STA together with the Ministry of Finance, Peoples’ Bank of China, China Banking Regulatory Commission, China Insurance Regulatory Commission and China Securities Regulatory Commission jointly issued the Administration Measures on Due Diligence Procedures for Non-residents’ Financial Account Information in Tax Matters (“the Measure”).

The Measures has made certain modifications and clarifications to the Draft Management Rule and uses the Tax Collection and Administration Law and the Anti-money Laundering Law as legal basis for AEOI implementation in Mainland China which is basically consistent with the framework and requirements proposed by the Organization for Economic Co-operation and Development. The Measure has been in force from 1 July 2017 and Mainland China’s first exchange of financial account information took place in 2018.

What financial account information will be required to be exchanged?

Under the Measure and related AEOI rules in Mainland China, once the financial accounts (including deposit accounts, custodian accounts and other accounts which meet certain conditions) are determined by the financial institutions to be reportable accounts, the information required to be reported by the financial institutions in Mainland China to the Chinese tax authorities includes but are not limited to the following:

|

Account holder information |

· Name

· Address · Jurisdiction(s) of residence · Taxpayer Identification Number(s) (TINs) · Personal particular for individual accounts including date of birth & place of birth |

|

Account information |

· The account number

· The name and identifying number (if any) of the reporting financial institution |

|

Financial information |

· The account balance or value as at 31 December

· The total gross amount of interest paid or credited to the relevant account during the calendar year · The total gross amount of dividend paid or credited to the relevant account during the calendar year · The total gross proceeds from sale or redemption of financial assets paid or credited to the relevant account during the calendar year |

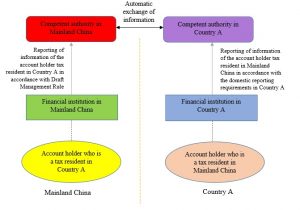

How does AEOI take place?

The diagram below briefly depicts the flow of AEOI between Mainland China and the reportable jurisdictions:

What are the potential impacts of AEOI on taxpayers?

Apparently, the introduction of AEOI will significantly enhance the transparency of tax information among tax jurisdictions. The information of income/assets earned/maintained by a Chinese individual/entity in foreign tax jurisdictions will potentially be made available to the Chinese tax authorities.

This also applies to the individual/entity resident in foreign countries who has income/assets earned/maintained in Mainland China. As such, it is high time for taxpayers to double check their tax residency to avoid erroneous exchange, review their tax position and ascertain any tax exposures in every relevant jurisdiction.