Bookkeeping Simplified: Key Concepts Every Business Owner Should Know

Bookkeeping involves meticulously recording and tracking every financial transaction that occurs within an organisation.

In this article, we’ll delve into the importance of bookkeeping, explore its fundamental concepts, and clarify its role in comparison to accounting.

What is bookkeeping?

At its core, bookkeeping is the practice of recording and tracking the financial transactions of a business. This process involves summarising these activities into reports that provide insights into the business’s financial health.

Beyond simple record-keeping, bookkeepers often take on tasks such as invoicing, paying bills, monitoring key performance indicators, and offering strategic advice.

The importance of bookkeeping

Accurate bookkeeping is crucial for providing up-to-date financial information about a business.

It ensures that business owners and managers have the data they need to make informed decisions.

Effective bookkeeping systems empower businesses to plan budgets, prepare for tax time, and strategise for future growth.

When financial records are accurate, tasks like establishing a budget or planning for the next fiscal year become much simpler and more efficient.

Key bookkeeping tasks

Bookkeeping encompasses several critical components and steps essential for understanding a business’s financial health and identifying any monetary issues that may arise. Key tasks include:

- Documenting every financial transaction (payments and expenses).

- Recording all debits and credits.

- Sending invoices and processing payments.

- Preparing financial statements (balance sheet, income and cash flow).

- Maintaining and balancing a general ledger.

- Conducting daily banking activities.

Basic bookkeeping concepts

Whether you do it yourself or outsource your bookkeeping, understanding its basic concepts is important. Here are some key terms and concepts:

- Ledger: The primary place where business transactions are recorded and categorised.

- Accounts: Categories under which all business transactions are classified.

- Assets: Items owned by the business, including inventory and money owed to the business (accounts receivable).

- Liabilities: Debts the business owes, such as unpaid bills, taxes, wages, or loans.

- Equity: Funds introduced and reserved by the owner or shareholders. In other words, it is the remaining value of the owner’s interest in the company.

- Revenue: Income generated from sales, interest, or dividends.

- Expenses: Costs incurred to keep the business operational.

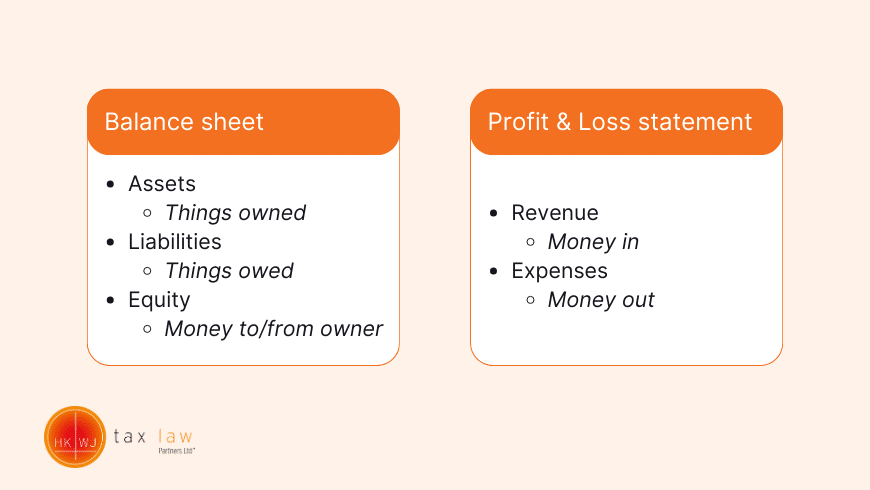

- Financial statements: Reports showing the financial status at the specific point in time (the balance sheet) and performance of a business (profit and loss statement).

- Balance sheet (also known as the Statement of Financial Position): A statement that lists the business’s assets, liabilities and owner’s equity.

- Profit and Loss (P&L) Statement (also called Income Statement): A report that summarises revenue and expenses, indicating the business’s performance during a given period.

- Chart of accounts: A comprehensive list of all accounts used to record financial transactions in the ledger.

- Journal entry: Any recorded transaction in the accounts.

Bookkeeping vs. Accounting

While bookkeeping and accounting may appear similar, they serve distinct functions within a business.

In general, bookkeeping serves as a preliminary function through the straightforward recording and organising of financial information. Accounting builds on this foundation by analysing and interpreting the data to inform strategic decisions.

As such, bookkeeping focuses on the day-to-day maintenance of financial records.

Accounting, on the other hand, involves the analysis, reporting, and summarisation of the data collected by bookkeepers.

Accountants provide a comprehensive picture of a business’s financial performance and determine tax liabilities.

HKWJ can help

Effective bookkeeping is the backbone of any successful business. It provides the accurate financial information necessary for informed decision-making and strategic planning.

For businesses seeking expert assistance in both bookkeeping and accounting, HKWJ Tax Law & Partners offers a team of seasoned professionals ready to manage your financial records and provide insightful analysis.

Contact us today to discover how we can support your business’s financial needs and help you navigate towards a prosperous future.