Housing Benefits & Allowance in Hong Kong

Housing benefits received by directors/employees from employers or the employers’ affiliated corporations are generally subject to salaries tax in Hong Kong unless an offshore/exemption claim on their directors’ fees/employment income can be satisfied. However, the salaries tax can be potentially mitigated in most circumstances in case the housing benefits are provided in the form of a rent-free or rent-subsidised residence, instead of merely a cash allowance.

Provision of a rent-free residence is in general the arrangement that the employers/the employers’ affiliated corporations purchase or lease a residence and provide that residence to the directors/employees for accommodation, whereas provision of a rent-subsidised residence is in general the arrangement that the employers/the employers’ affiliated corporations reimburse wholly or partly the rental incurred by the directors/employees.

The Relevant Tax Rules on Housing Benefits

According to the Hong Kong Inland Revenue Ordinance, allowance including housing cash allowance is included as assessable income and the actual amount is added to salary in calculating the salaries tax liabilities in Hong Kong. However, if the directors/employees are provided with a place of rent-free or rent-subsidised residence, the housing benefits will be taxed based on a deemed rental value, which is calculated at 4% / 8% / 10% of the assessable income (after deducting the outgoings and expenses) earned from their employers/the employers’ affiliated corporations, depending on the type of the accommodation.

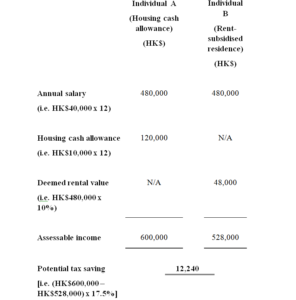

An Example of Potential Tax Saving

In order to better understand the potential tax saving in respect of the housing benefits provided in the form of a rent-free or rent-subsidised residence, an example is given below:

Individual A’s monthly salary is HK$40,000 and his monthly housing cash allowance is HK$10,000. Individual B’s monthly salary is also HK$40,000, but he is reimbursed by his employer with a rental of HK$10,000 each month for his flat. Assuming both individuals are taxed at the highest progressive rate of 17%, the assessable income under the above two situations and the tax saving are calculated as follows:

Relevant Tax Issues on Housing Benefits

In order to avoid the abuse of the potential tax saving arrangement, the Hong Kong Inland Revenue Department (‘HK-IRD’) has been very stringent in assessing the taxable housing benefits. In case the directors/employees claim with the HK-IRD that they are provided with a place of rent-free or rent-subsidised residence, the HK-IRD would probably examine the validity of the claim and usually look at, amongst others, whether or not,

- The employers have the intention to provide a place of residence to the directors/employees

- The employers have established clear guidelines/policies regarding the provision of a place of residence to the directors/employees

- The employers have exercised proper control over how the directors/employees spend over the rental reimbursed by the employers.

For the purpose of entitling to the potential tax benefits, it is important to have the employment contract and company policy regarding provision of housing benefits well prepared and also have the relevant tenancy agreement, rental reimbursement claim form and rental receipt well maintained. For further tax advice on the housing benefits or other tax matters, please feel free to contact HKWJ Tax Law & Partners Limited.